Using the right budget forecasting method helps you predict what’s coming, whether it’s revenue growth, expenses, or cash flow changes. Choosing the right methods makes planning easier and gives you a clear view of your company’s financial future.

In this guide, we’ll go through the most useful budget forecasting methods, techniques that sharpen your forecasts, and some of the tools that make the process more efficient.

5 Common Budget Forecasting Methods/Frameworks

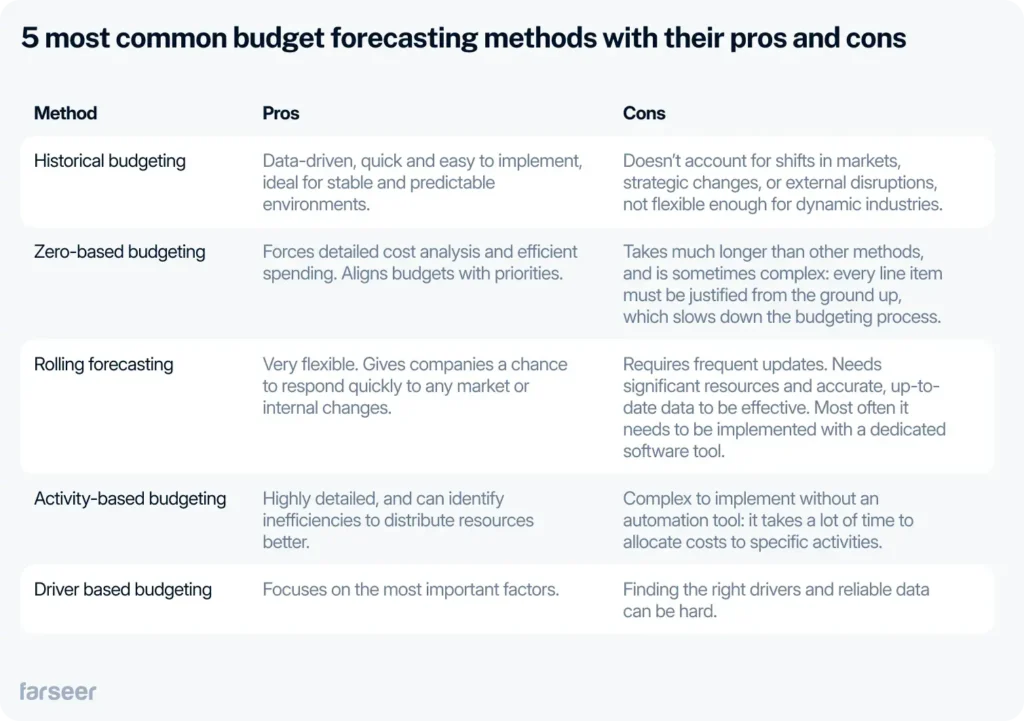

Companies can rely on different methods of budget forecasting, depending on their size, industry, and goals. We’ll guide you through 5 of the most common ones. Each of them has its strengths and weaknesses.

Historical Budgeting

One of the simplest and most common forecasting methods. It uses financial data from previous years to predict future revenue, expenses, and cash flow. Historical budgeting assumes that past trends will continue, making it particularly useful for companies with stable operations.

Example:

A large manufacturing company can notice that its raw material costs have increased by 3% each year over the last five years. They’ll simply increase the next year’s budget by 3%, and project the cost for the upcoming period.

Pros: Data-driven, quick and easy to implement, ideal for stable and predictable environments.

Cons: It doesn’t account for shifts in markets, strategic changes, or external disruptions, not flexible enough for dynamic industries.

Zero-Based Budgeting

This budget forecasting method starts from scratch each budgeting period, eliminating the need for past data. Every expense must be justified for the new period. In zero-based budgeting, departments, and managers need to justify their costs as if they were starting with a clean slate, making it ideal for finding inefficiencies and aligning spending with strategic goals more rigorously.

Example:

Unilever cut unnecessary spending and allocated resources more efficiently using zero-based budgeting. They questioned every single cost, so they could significantly reduce operating expenses.

Pros: Forces detailed cost analysis and efficient spending. Aligns budgets with priorities.

Cons: Takes much longer than other methods, and is sometimes complex: every line item must be justified from the ground up, which slows down the budgeting process.

Rolling Forecasting

Rolling forecasting adjusts business financial projections continuously throughout the year. In more simple words, it’s a financial model that moves forward one month at a time. It doesn’t rely on static annual budgets but updates the forecast regularly (monthly or quarterly) so it always reflects the latest data and market conditions. It’s a flexible and real-time approach.

Example:

Procter & Gamble uses rolling forecasts to manage its global operations. It automates data collection to respond swiftly to changing consumer demands without relying on manual updates. This helps them adjust their forecasts quickly, aligning resources with market conditions.

Pros: Very flexible. Gives companies a chance to respond quickly to any market or internal changes.

Cons: Requires frequent updates. Needs significant resources and accurate, up-to-date data to be effective. Most often it needs to be implemented with a dedicated software tool.

Activity-Based Budgeting

In activity-based budgeting, costs are allocated by activities that drive the expenses (production, customer service, logistics, etc). In this method, companies don’t group expenses by department, but by the priority of where resources should be used. This way, they can have a better picture of how money is spent, and they can highlight areas where they can improve efficiency.

Example:

Manufacturers like Caterpillar use activity-based budgeting to keep production and supply chain costs as low as possible. They select activities that drive costs, such as machine setups and material handling, distribute budgets more accurately, and reduce waste, so the operations are efficient.

Pros: Highly detailed, and can identify inefficiencies to distribute resources better.

Cons: Complex to implement without an automation tool: it takes a lot of time to allocate costs to specific activities.

Driver-Based Budgeting

Driver-based budgeting focuses on the key factors, or “drivers,” with the most significant impact on a company’s costs and revenues. Those can be sales volume, production output, labor costs, etc. The idea is to identify the few critical drivers that directly affect financial performance and build the budget around them. By focusing on the drivers, businesses can simplify budgeting and adapt to any outside or inside changes more quickly.

Example:

Walmart uses driver-based budgeting by focusing on sales per square foot to adjust inventory and staffing. This lets them respond quickly to changes in customer demand during peak shopping seasons, such as the holiday period.

Pros: Focuses on the most important factors.

Cons: Finding the right drivers and reliable data can be hard.

Forecasting Techniques to Use for Better Budget Accuracy

The budget forecasting methods we talked about so far are methods or frameworks that structure the budgeting process. To improve accuracy and reliability in these methods, companies use qualitative and quantitative forecasting techniques.

Qualitative Forecasting Techniques

Qualitative techniques are used when there’s no historical data, or when it’s insufficient. They rely on expert opinions and external data and are especially useful for predicting new market trends, launching products, or navigating uncertain conditions. Quantitative approaches use numerical data, but qualitative techniques are more flexible and based on subjective judgment. Apple launched the first iPhone without any historical data. They didn’t sell smartphones before so they had to rely on market research to estimate the demand.

When to use: When entering new markets or launching products with no historical data, navigating high market volatility, or when expert judgment is needed to predict trends.

Delphi Technique

Companies use the Delphi Technique when they need structured input from experts. In a nutshell, it’s just gathering expert input through several rounds of feedback. In each round, experts provide an anonymous forecast, and after each round, their responses are gathered and shared with the group. This repeats until the group reaches a consensus.

Market Research

Market research is sometimes used combined with the Delphi technique. In simple words, it’s gathering data about what their buyers want, what’s competition up to, and what market trends are showing. Companies conduct surveys, focus groups, and industry reports and try to predict demand when they don’t have historical data.

Quantitative Forecasting Techniques

Quantitative techniques are used when companies have historical data and can use it for more objective forecasting and predictions. There are several different techniques here:

Time Series Analysis

The name comes from examining a sequence of data points organized by time. Here, businesses forecast based on historical data recorded at regular intervals (daily, monthly, yearly) so they can find patterns like trends or seasonality cycles.

Example:

Amazon uses time series to forecast sales during Black Friday. They predict demand spikes and adjust inventory and logistics based on past sales data. This way, they will have enough stock and resources ready.

Regression Analysis

Regression analysis helps find and understand the connection between two or more variables. It helps predict one thing i.e. sales based on changes in another i.e. advertising spend. This way, companies can forecast outcomes by examining the influence between factors. Most commonly, simple linear and multiple regression are used. Simple linear compares only two variables, for example, marketing spend vs sales, and multiple regression compares more variables – marketing spend, customer satisfaction, and product quality.

Example:

A car manufacturer like Ford will use regression analysis to see how the demand changes when fuel prices increase or decrease. They’ll analyze fuel prices and car sales historical data to learn how fuel cost changes impact consumer preferences for fuel-efficient car models, so they can adjust their production.

Moving Averages

Moving averages “smooth out” short-term spikes and drops in data, to see long-term trends. This method takes the average of a set number of past data points, like sales over the last 6 months, and moves forward. Each time when there’s new data, the average is recalculated. That way, it helps focus on the overall trend rather than getting distracted by short-term fluctuations.

Example:

Starbucks predicts coffee sales like this. Instead of focusing on one busy holiday week, they average the sales from the past three months to see a clearer trend. This allows them to anticipate demand accurately, and always have the right stock of coffee at hand.

Scenario Analysis

This technique predicts possible future outcomes by creating different scenarios. Usually, it’s best-case, worst-case, and most likely. It tries to forecast how each case impacts overall business performance.

Example:

Unilever plans for the potential impact of climate change on its supply chain this way. They create scenarios for how climate regulations might evolve, how severe weather could affect agricultural production, and what will happen with raw material costs. With this data, they can adjust their supply chain and prepare for different outcomes.

Sensitivity Analysis

Sensitivity analysis is changing one independent variable (like sales price or volume) and investigating how it affects the dependent variable (like revenue or profit) in the model for the same period. It helps businesses understand which factors are most sensitive to change and how those changes impact their outcomes.

Example:

Tesla uses sensitivity analysis to see how changes in lithium prices affect its profitability. By adjusting lithium costs in their model, they can estimate how price fluctuations affect profit margins and decide whether to adjust production or sourcing strategies.

Monte Carlo Simulation

Monte Carlo simulation is a mathematical technique that runs many random scenarios to show possible outcomes. It’s especially useful for complex situations with multiple variables. While moving averages or time series analysis focus on trends and patterns, Monte Carlo gives a range of possible outcomes with probabilities.

Example:

A bank like Goldman Sachs would use Monte Carlo simulations to forecast the risks and returns of investment portfolios. They would simulate different market conditions and try to understand the potential outcomes.

How to Avoid the Most Common Budget Forecasting Mistakes

Whatever methods and techniques you choose, some mistakes are bound to happen. Here are the most common ones to watch out for:

Don’t rely only on historical data

Mistake: It often happens that people assume that past performance will always repeat. If this was the case, we’d all be psychic.

Solution: Incorporate external factors like market changes or economic shifts that can (and probably will) affect future results.

Revisit your forecasts regularly

Mistake: Letting forecasts get outdated. People often “set them and forget them”.

Solution: Use rolling forecasts and update regularly to stay accurate.

Don’t ignore qualitative data

Mistake: Being specific and objective is great, but relying only on numbers is not enough.

Solution: Enrich your numbers with expert opinions and do market research for a broader picture.

Keep your assumptions as realistic as possible

Mistake: Being too optimistic or pessimistic about sales growth or expenses can skew your forecasts.

Solution: Use sensitivity analysis or scenario analysis to test and adjust what you assume.

Being too optimistic about sales growth or underestimating expenses can throw off your forecasts. Flexible budget variance can also help identify and address these issues.

Ready to Confidently Forecast Budgets?

When you choose the right budget forecasting methods, avoid common mistakes, and combine qualitative insights with solid data, you’ll put your business in a stronger position to face the future.

Regularly revisiting your forecasts ensures you stay agile and ready for whatever comes next.

Read: Budget vs Actual Explained: How Does It Affect Your Business?