Let’s face it – there’s hardly a financial plan that survives first contact with reality. And budget vs actual is where those plans get tested in the real world. The whole story is actually really simple: compare what you had planned to spend or earn with what actually happened.

But the insights it provides? Can be game-changing. Especially for businesses in fast-moving industries like FMCG or manufacturing.

Related: Rolling Forecast – 101 Guide For Smarter Planning

A well-thought-through budget might set targets for marketing, production, or logistics, but unexpected shifts (like rising raw material costs or a sudden increase in demand) can quickly throw things off course.

In this blog, we’ll break down the why, what, and how of budget vs actual analysis and show how it can keep your financial goals aligned with the realities of running a business.

Why Comparing Budget vs Actual is Critical

Imagine this: your team carefully plans a budget for the year, but a few months later, expenses are higher than expected, or revenues fall short. Without a budget vs actual analysis, these red flags might go unnoticed until they turn into major problems.

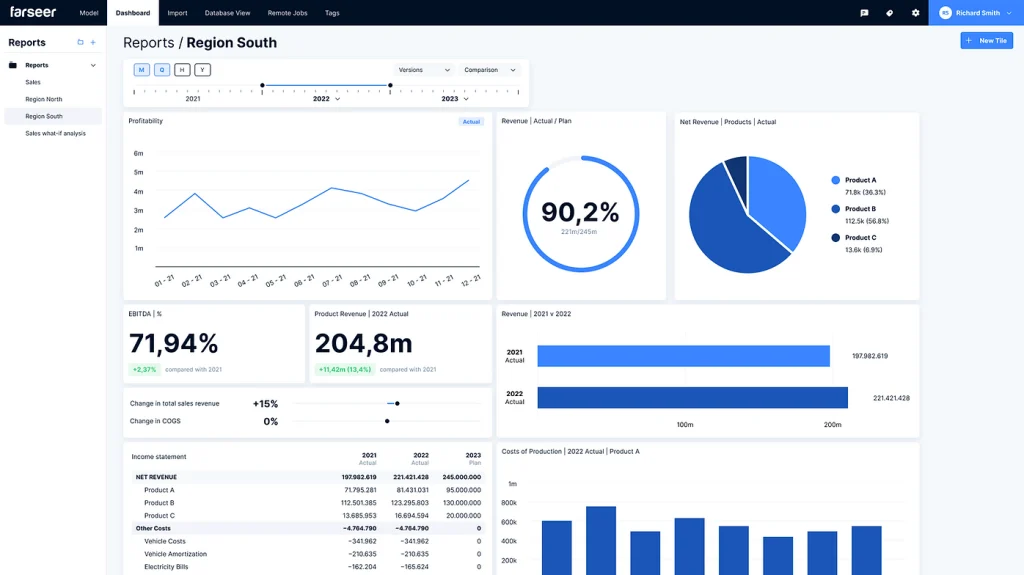

These discrepancies between your budget and actual performance are signals – showing cash flow issues, squeezed profitability, or misaligned operations. Violeta faced this challenge when planned sales targets didn’t match actual performance across multiple SKUs and markets. With Farseer’s automated budgeting and variance tracking, they improved forecast accuracy and quickly adjusted to real-time changes, reducing budget gaps.

Take this example: a manufacturing company budgets $500,000 for raw materials, but half a year through, the supply chain experiences major disruptions, which drives your actual costs to $700,000. If you don’t spot the variance early, the company might miss the chance to adjust prices or cut unnecessary spending, ending ultimately in cash flow problems.

If you compare budgets with actuals regularly, you can:

- Spot overspending before it cuts into profits.

- Adjust operations to manage cash flow more effectively.

- Make informed decisions based on real data, not outdated assumptions.

Key Components of a Budget vs Actual Comparison

To get the most out of budget vs actual analysis, it’s necessary to focus on its core components. It’s all about organizing the numbers into clear categories that show where your plan is working, and where it’s off track.

Here’s what to take into concern:

1. Revenue

Revenue is your top line, and any discrepancies between budget and actual here are a clear warning. If actual revenue is below budget, it could mean that you didn’t achieve your sales goals, that there are some issues in the market, or that you’re underperforming in key areas. On the other hand, higher-than-expected revenue might point to unexpected growth opportunities. And you’re probably aware that if you don’t recognize growth opportunities on time, you may just miss out on them.

2. Expenses

There are 2 types of expenses that you need to pay attention to:

OPEX (Operational Expenses) and CAPEX (Capital Expenditures).

OPEX are day-to-day expenses like salaries, marketing, and utilities. If you see a spike here, this can mean that you’re running your business inefficiently or that you’ve had unplanned costs. A detailed spend analysis can help pinpoint where unexpected cost increases are happening and identify opportunities for savings. CAPEX on the other hand are investments in assets like machinery or software. If you notice variances in CAPEX, this may be a signal of project delays or cost overruns.

3. Variance analysis

This is where the magic happens – comparing budgeted amounts with actuals to identify the why behind the numbers. Positive variances (actuals below budget) might look good but could signal missed opportunities, while negative variances (actuals above budget) often point to inefficiencies or failures in zero-based budgeting or unforeseen challenges.

Read 5 Budget Forecasting Methods + Techniques to Improve Financial Planning

Tools and processes: moving beyond spreadsheet

While many companies rely on spreadsheets for budget vs actual analysis, this approach has serious challenges:

- Manual errors: A single formula error can lead to quite expensive mistakes.

- Time-intensive: Gathering data from multiple sources eats up valuable time.

- Lack of real-time updates: Spreadsheets can’t keep up with today’s dynamic business needs.

Modern FP&A tools like Farseer streamline the process, enabling real-time tracking, automated variance analysis, and integration with ERP systems. With features enhanced by AI in accounting, these tools reduce errors, improve accuracy, and free up your team to focus on strategy rather than struggling with data issues.

Best Practices for Effective Budget vs Actual Analysis

If you want to get the most out of budget vs actual analysis, you’ll need to go further from just analyzing numbers. It’s about adopting practices that ensure accuracy, efficiency, and useful insights. Here’s how to make your comparisons count:

1. Establish clear KPIs and benchmarks

First – you’d want to define what success means.

Setting specific Key Performance Indicators (KPIs) and benchmarks tailored to your business keeps everyone aligned. In this case, metrics like EBIT margin, cost-per-unit, or revenue-per-region provide clear goals and help identify variances that need attention.

For example, a manufacturing company might use cost-per-unit as a key benchmark. If the actual cost goes over the budgeted amount, they’d look into what’s causing it (maybe it’s production inefficiencies or rising raw material prices) so they can quickly make adjustments.

Read Budgeting vs Forecasting – Key Differences and When to Use Each

2. Automate variance tracking with FP&A tools

Tracking variances manually often leads to delays and mistakes. This is where modern FP&A tools jump in.

They automate the whole process. And not just that. They offer real-time variance analysis, reduce the risk of errors, and they can instantly flag any deviations. This allows businesses to respond quickly and effectively to anything suspicious going on.

3. Collaborate across departments

Accurate budget vs actual analysis relies on input from different teams – sales, procurement, production, etc. Neglecting this collaboration may lead to incomplete or inaccurate data that can disrupt your numbers. Imagine you have a sales team that doesn’t communicate with finances or marketing! Sounds like a recipe for disaster.

Therefore, it’s important to build a culture of shared accountability. This will ultimately help ensure everyone provides timely and reliable information.

Tools for Budget vs Actual Analysis

When it comes to Budget vs Actual analysis, the tools you use can be a huge game-changer. Many businesses still rely on spreadsheets, but nowadays these often cause more problems than help, especially in dynamic industries. Modern FP&A tools are the way to go here, with features that go far beyond manual systems.

Key features of FP&A tools

- Real-time reporting. FP&A tools provide real-time access to financial data. This allows businesses to track performance as it happens and it’s especially useful in dynamic industries like FMCG, where quick reactions can make a big difference.

- Automated variance tracking. Instead of manually calculating variances, FP&A tools automate the process. Alerts can be set up to notify teams of significant deviations, enabling faster corrective actions.

- Scenario planning. One of the most valuable features of modern tools is the ability to run scenarios. When you model potential outcomes based on different variables (e.g., changes in revenue or costs), businesses can make informed decisions even in uncertain conditions.

Read 5 Best Financial Analysis Tools to Look Out For in 2025

Turning Budget vs Actual into a Strategic Advantage

Budget vs actual comparisons are not just your regular financial check. They keep your business aligned with its goals. Spotting gaps between plans and reality makes it easier for you to fix inefficiencies, grab opportunities, and make smarter decisions. This is where modern FP&A tools make a difference. They offer real-time insights, automated variance tracking, and scenario planning to make the process faster and more accurate.

If your current approach feels clunky, it’s time to upgrade. The right tools can save time and give you the clarity to tackle complex financial challenges with confidence. So, are your tools helping you – or holding you back?