Struggling with monthly financial reports?

You’re not alone.

They’re essential for tracking your company’s financial health, covering cash flow, budgets, and performance. But putting them together can be frustrating.

Manual data entry, disorganized systems, and a lack of real-time updates often turn this task into a time-consuming headache.

Read What is Financial Statement Consolidation, and How to Make it Simple

Here’s the good news: simplifying this process is totally possible. This guide will take you through 7 easy steps to help you create financial reports that are accurate, insightful and time-saving.

Whether you’re managing complex financial data or just looking for a more efficient way to handle things, we’ve got you covered.

Why Monthly Financial Reporting Matters

Getting your monthly financial reports on time is crucial for keeping your business running smoothly. These reports give you everything you need to manage cash flow, stick to your budget, and ensure your financial performance aligns with your strategic goals.

Take a retail chain, for example – they can use monthly reports to get a better overview of inventory levels. This ensures that they’re not stuck with too much stock or running low on products. Both situations can really hurt their end result, so having the right info at the right time makes all the difference.

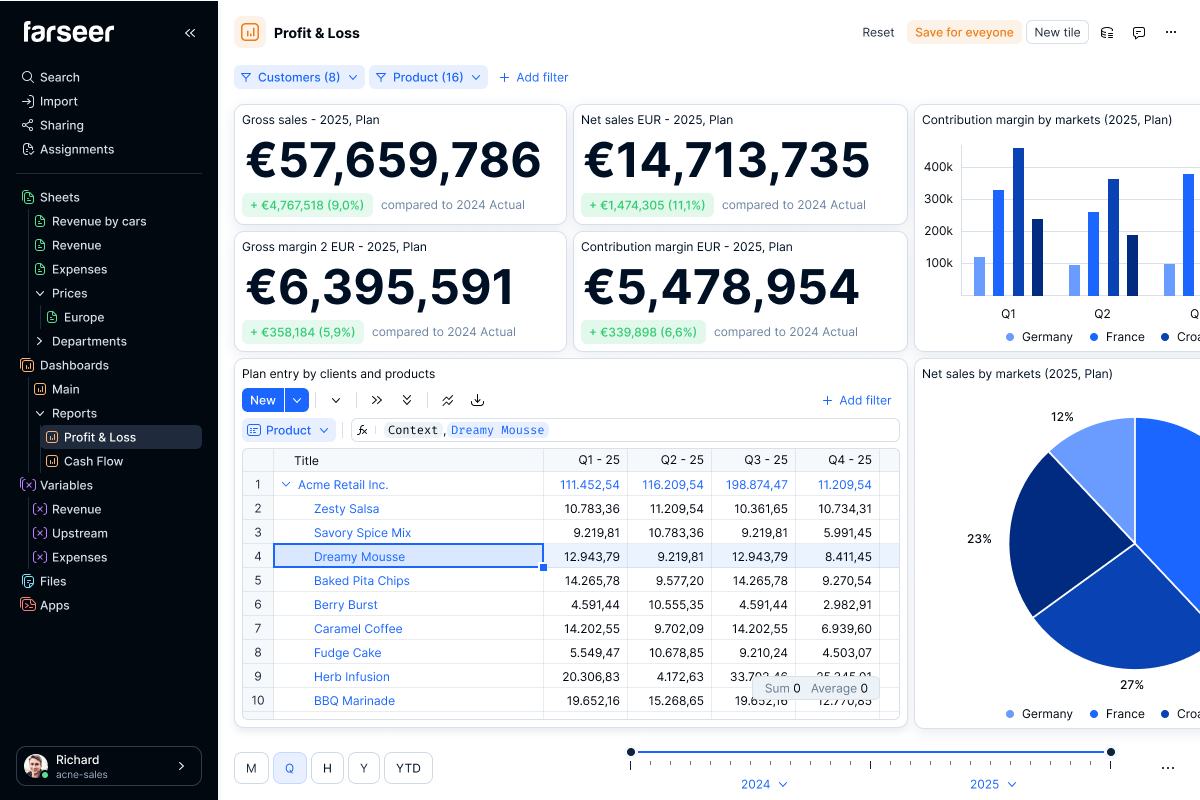

The great news is that integrated FP&A tools can simplify the entire process. They bring all your data together, automate calculations, and provide real-time insights, so you can make fast, confident decisions without the hassle of manual work.

Monthly Financial Report in 7 Steps

Step 1: Define your reporting goals

The first step in creating effective monthly financial reports is to clearly define your reporting goals. Your first task is to understand what management and stakeholders need to see. Are they focused on tracking revenue against forecasts, monitoring cost center performance, or ensuring compliance with regulatory standards? Or maybe something else?

For example, leadership might want a clear view of revenue shortfalls so they can tweak sales strategies, while department heads may need cost center analysis to make sure they stay on budget. If you define these goals before you start creating the report, you’re making sure your reports aren’t just plain numbers – they provide the insights that really matter to your organization’s priorities.

Step 2: Collect and bring together all your data

Collecting data is your next step when creating accurate financial reports. This means you need to pull info from different sources like ERP systems, CRM platforms, spreadsheets, and other tools your organization uses. But here’s the catch: doing it all manually can lead to mistakes and delays, especially in larger companies. That’s where automating data collection is a real life saviour. It speeds up the process and helps keep things accurate.

Let’s say you work in a company with more subsidiaries. You can improve your reporting if you automate data collection. Instead of manually pulling together inputs from different teams, you can use an integrated FP&A tool to centralize everything. This saves time, and also makes your reports and forecasts more reliable.

Step 3: Establish a reporting framework

Setting up a reporting framework is key to making sure your financial reports are clear, consistent, and easy to understand. Start by picking the right types of reports for your needs, like profit and loss statements, balance sheets, or cash flow reports, depending on what’s most important for your business. Then, standardize your key performance indicators (KPIs) so they stay consistent across reporting periods. This helps stakeholders easily compare performance and spot trends over time.

Take FMCG companies, for example. They often align KPIs like inventory turnover, gross margin, and advertising spend across departments to keep their reporting clear. When you create a standardized framework, this ensures everyone is on the same page and makes it easier to stay aligned on shared goals.

Step 4: Use automation to keep things accurate

As mentioned, automation tools are a game-changer if you’re looking to cut down manual tasks and reduce errors in financial reporting. So make sure to think of tools or platforms that can help you automate data. Companies can save tons of time and focus more on high-value work if they automate things like data entry, consolidation, and variance calculations.

Step 5: Analyze the results

This is where your financial report really shines – turning raw data into insights that you can act on. It’s about asking the right questions: What’s driving the gap between actual and planned figures? Are there any trends popping up that need attention? And most importantly, what steps can we take to improve performance? Variance analysis is key here, as it helps you spot where things are going off track and lets you take quick action to fix them.

Step 6: Visualize your findings

Dashboards and visualization tools can make all the difference when it comes to making financial data easier to understand and act on. They take complex data and turn it into clear, visual formats like charts, graphs, and interactive reports – way easier to digest than just a bunch of numbers. This makes it simpler for stakeholders to quickly catch the important insights and focus on what really matters.

There’s a great real-life example coming from DHL, a global logistics company. They struggled with the challenge of presenting complex logistics and operational data to its board and managers in a way that was easy to understand and act upon. Their reports were often too detailed, making it difficult to quickly identify key insights.

To solve this, DHL adopted Qlik’s visualization tools, which allowed them to create interactive dashboards. These dashboards displayed important metrics such as delivery efficiency, cost per shipment, and revenue trends in visual formats like charts and graphs. With these tools, the team could quickly drill down into specific data points during meetings to uncover deeper insights.

Step 7: Share and improve

It’s all about making key insights easy to access and act on. Keep things clear and simple, and tailor the format to your audience – executives might prefer high-level summaries, while department heads may need a bit more detail. Tools like cloud-based reporting platforms or shared dashboards make it easy to share reports securely and in real time, so you don’t have to worry about delays or version control issues.

Don’t forget about feedback loops – they’re essential for improving the quality and efficiency of your reports. Check in regularly with stakeholders about what’s working and what isn’t, only this way you can find areas to improve. For example, if management feels certain KPIs aren’t giving them the insights they need, you can adjust the framework to focus on metrics that align better with their goals. This back-and-forth process helps you create sharper, more impactful reports that continually add value to the business.

Conclusion

In a nutshell, effective monthly reporting is key to making smart decisions, and steering clear of common mistakes can really make a difference. By focusing on the seven steps we’ve covered – like simplifying KPIs, ensuring data consistency, and using integrated tools – you can streamline your reporting, improve accuracy, and provide clearer insights for decision-makers. These steps make your reports more efficient and help drive faster, better decisions that can lead to business success.

If you’re ready to level up your reporting process, check out modern FP&A solutions like Farseer.