Net working capital is one of the simplest ways to check if your business is financially healthy. But too many companies overlook it. If you don’t know whether you can cover your short-term bills or invest in potential opportunities, you might be setting yourself up for trouble.

Read: A Complete Guide to Financial Statement Analysis for Strategy Makers

In this blog, we’ll explain why net working capital matters, how to calculate it and share simple tips to improve it.

Let’s make sure your business has the cash it needs to keep moving forward.

What Is Net Working Capital?

Simply put, net working capital is the difference between your current assets and current liabilities. It’s one of the quickest ways to make sure your business can cover short-term bills and still have resources left over for growth.

Think of net working capital as a financial buffer that helps keep operations running properly. If it’s positive, your assets outweigh your liabilities, which is great for stability. Negative net working capital might signal a cash crunch. (unless your business operates in a fast-turnover industry like retail, but more on that later)

Why Managing Net Working Capital Is Important

Keeping an eye on net working capital makes sure your business has enough cash to cover its bills and invest when opportunities come up. If not managed well, you could run into cash flow problems, miss payments, or lose out on chances to grow.

Businesses with solid working capital can easily handle unexpected costs. Whether your NWC is positive or negative, managing it well keeps things running and helps you avoid unnecessary financial headaches.

To get the best picture of your company’s finances, you might want to check out our guide to 7 balance sheet ratios.

How to Calculate Net Working Capital

Three formulas are usually used to calculate net working capital. Retail and FMCG businesses often focus on inventory and payables, while manufacturers might prioritize receivables and inventory. Each one of them fits specific business needs.

Standard Formula for Net Working Capital

This is the simplest way to calculate your net working capital. Just subtract your current liabilities from your current assets.

This method gives you a quick look at your business’s short-term financial health. It’s perfect for basic overviews or comparing your company to others in your industry.

Example: Let’s say your business has $500,000 in current assets and $300,000 in current liabilities:

Net Working Capital = $500,000 – $300,000 = $200,000

A positive result like this means your business has enough short-term resources to cover its bills and keep running without problems.

This version gives you a better look at how much working capital is tied directly to your operations.

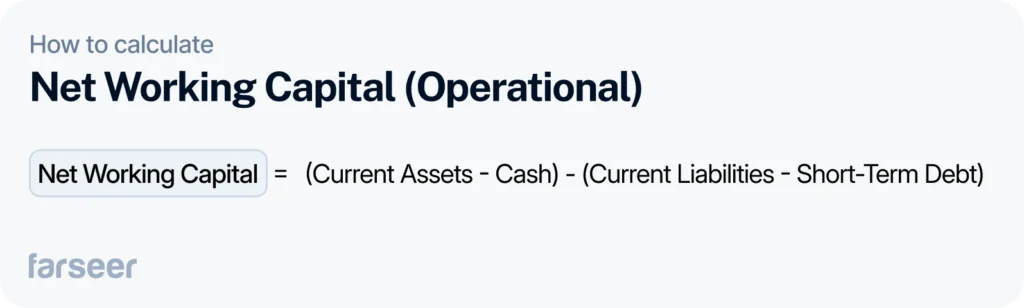

Operational Formula for Net Working Capital

This formula focuses on your business’s daily operations. It leaves out cash and short-term debt. It’s helpful for industries like retail or FMCG, where inventory and payables are more important than cash reserves.

Example: Imagine your retail business has $400,000 in current assets, $50,000 in cash, $250,000 in current liabilities, and $30,000 in short-term debt:

Net Working Capital = ($400,000 – $50,000) – ($250,000 – $30,000)

Net Working Capital = $350,000 – $220,000 = $130,000

This version gives you a better look at how much working capital is tied directly to your operations.

Simplified Formula for Net Working Capital

This formula focuses on the core components of working capital: accounts receivable, inventory, and accounts payable. It’s great for analyzing how well your business manages cash flow.

Example: Let’s say your company has $80,000 in accounts receivable, $120,000 in inventory, and $50,000 in accounts payable:

Net Working Capital = $80,000 + $120,000 – $50,000

Net Working Capital = $150,000

This approach highlights the efficiency of key drivers of working capital, your receivables, inventory, and payables.

Net Working Capital Components

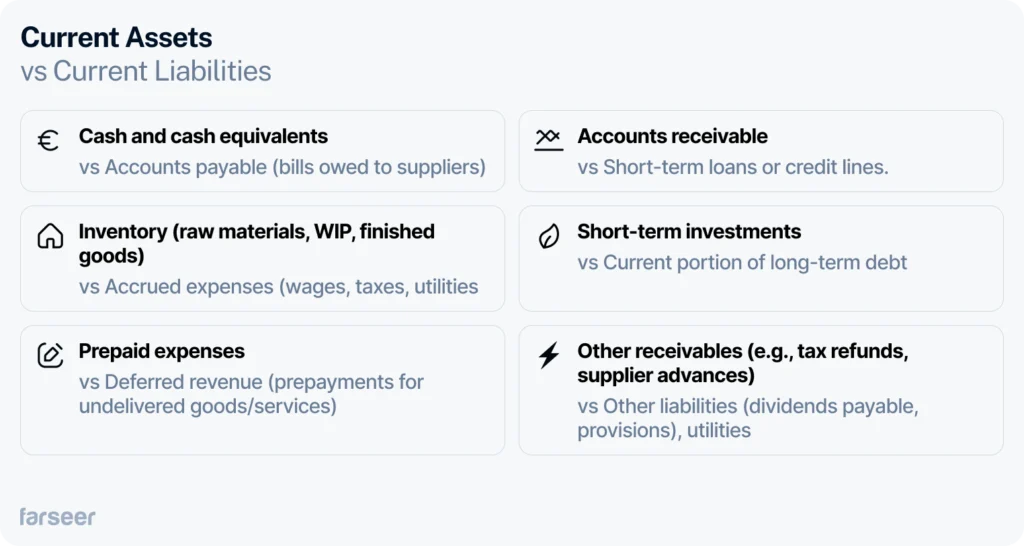

Net working capital consists of two key elements: current assets and liabilities. They are the short-term resources and obligations that keep your business running.

Current Assets

Current assets are resources expected to turn into cash within a year.

These include:

- Cash and cash equivalents (e.g., checking accounts, savings accounts)

- Accounts receivable (money owed by customers)

- Inventory (raw materials, work-in-progress, and finished goods)

- Short-term investments (e.g., marketable securities)

- Prepaid expenses (e.g., rent or insurance paid in advance)

- Other receivables (e.g., tax refunds, interest receivable, or supplier advances)

For more details on how current assets are organized, see our guide on classified balance sheet.

Current Liabilities

Current liabilities are obligations that need to be settled within a year. These include:

- Accounts payable (bills owed to suppliers)

- Short-term loans or credit lines

- Accrued expenses (e.g., wages, taxes, or utilities not yet paid)

- Current portion of long-term debt (payments due soon)

- Deferred revenue (prepayments for goods or services still to be delivered)

- Other current liabilities (e.g., dividends payable or short-term provisions)

Positive vs. Negative Net Working Capital

As mentioned earlier, net working capital (NWC) tells you if your business has the resources to meet short-term bills. A positive NWC means your current assets are higher than liabilities, which usually shows stability. A negative NWC means the opposite, but it’s not always bad. It usually depends on your industry.

Positive Net Working Capital

Positive NWC means your business can cover short-term bills and still have room to invest.

Example: Microsoft had $184.4 billion in current assets and $95.3 billion in current liabilities as of June 30, 2023. This gave the company $89.1 billion in positive NWC.

Negative Net Working Capital

Negative NWC happens when liabilities are higher than assets. True, it can mean cash flow issues, but some industries, like retail, make it work by turning inventory into cash quickly and delaying payments to suppliers.

Example: Walmart operates with negative NWC. At the end of 1Q FY2022, it had $83.5 billion in current assets and $91.9 billion in current liabilities, leaving a negative NWC of $8.4 billion. Walmart’s strategy relies on selling goods fast and paying suppliers later.

Negative NWC is common in industries like retail, hospitality, and telco with quick turnover or prepayments. Positive NWC is typical in manufacturing, technology, and pharmaceuticals where liquidity supports long cycles and growth.

How to Improve Net Working Capital

Improving net working capital starts with better management of its key components: accounts receivable, inventory, and accounts payable. Let’s break down each one.

Accounts Payable (Make Use of Discounts)

Supplier discounts can reduce liabilities and improve NWC, but they must be balanced with cash needs. Early payments save money but leave less cash for other expenses.

- Take early payment discounts.

- Make sure to balance the need for cash with using provided supplier discounts.

Example: A manufacturing company is offered 2/10 net 30 payment terms from its suppliers. Using up the 2% discount might be wise if the company is looking to boost its NWC. By paying 2% less, less cash is used up to cover the accounts payable, increasing the total overall NWC. However, the company should keep in mind that less cash will be available for use because of the payments made to the suppliers.

For more ideas to optimize your accounts receivable, check out our detailed guide on accounts receivable.

Refinance Short-Term Debt (Restructure Liabilities)

Replacing short-term debt with long-term financing can reduce current liabilities, directly improving net working capital. This strategy works best for businesses with reliable cash flow to manage long-term repayment obligations

- Evaluate current short-term liabilities and assess which can be refinanced.

- Work with financial institutions to secure favorable long-term loan terms.

- Use savings from lower current liabilities to invest in growth or improve liquidity.

- Restructure debt by issuing bonds or similar long-term debt, using it to pay off short-term debts

Example: A logistics company refinanced a $500,000 short-term loan into a 5-year term loan. This reduced their current liabilities, freeing up working capital for fleet upgrades, which improved efficiency and profitability.

For more tips on streamlining operations, check out our guide to efficiency ratios.

Cut Unnecessary Costs (OPEX Cleaning)

Diligently analyzing your costs can reveal unnecessary costs that might show up from time to time due to inefficiency. Unobserved, these costs can add up either as cash expenditures or as an increase in accounts payable, leading to a worse NWC.

- Constantly monitor expenses with a degree of skepticism toward each new operating expense.

- Follow trends in your expenses to mitigate unnecessary expense increases.

- Cut out obsolete resources that might be knocking down your NWC.

Example: A manufacturing company had been purchasing materials for products that have become obsolete. These recurring orders have gone on for months before noticed and have accrued $80,000 of accounts payable. Stopping these orders immediately keeps NWC at current levels, without decreasing it further.

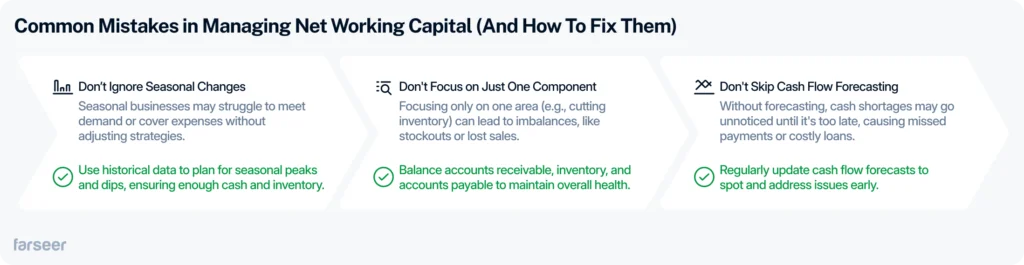

Common Mistakes in Managing Net Working Capital

Even small mistakes in managing net working capital can create big problems. Here are some common ones to avoid, and what you can do to fix them:

Conclusion

Net working capital shows if your business can handle short-term bills while investing in growth. By improving how you manage receivables, inventory, and payables, you can avoid cash flow problems and make better financial decisions.

FP&A tools like Farseer make this easier. They give you real-time insights and help with scenario planning—perfect for seeing how changes in NWC impact your business.

Start applying these strategies today and use Farseer to stay ahead and keep your finances on track.