Most companies spend weeks, sometimes months, fine-tuning their annual budget, only to see it become outdated within a few quarters. The truth is, relying on a projection vs forecast approach – where you set a target and hope it holds – just doesn’t cut it anymore. Markets shift, costs spike, and competitors move fast. And when that happens, your carefully crafted projection quickly turns into a guessing game.

This might’ve worked ten years ago. But today? It’s very risky.

Basically, in this scenario, you’re asked to run a complex business with numbers that don’t reflect your current reality. And when the market takes a turn, reacting feels more like crisis management than planned action.

Read Rolling Forecast – 101 Guide For Smarter Planning

That’s why rolling forecasts take the win here. But before jumping into the benefits, let’s clear up a common confusion: what’s the difference between a projection and a forecast?

What’s the Difference: Projection vs. Forecast

The terms often get mixed up in the projection vs forecast debate, but they have completely different purposes.

A projection is an estimation, aimed at a particular goal at a specific point in time, and most importantly – without taking external factors into concern. For example, you might project revenue for the next year (assuming everything goes to plan). It’s mainly useful for setting long-term targets and for evaluating potential scenarios.

A forecast, on the other hand, is alive. It’s updated regularly with the latest data, actual results, and market signals. It provides a realistic picture of your financial state based on existing historical data and trends. Forecasts are used for budgeting, financial modeling and planning operations.

Let’s say that an FMCG manufacturer builds a projection in November assuming a stable Q1. Then January hits and raw material costs spike 15%. A static projection ignores that. But a forecast reacts, showing that margin will be squeezed unless prices adjust or volume changes.

So the gist is – projections are static, mainly long-term and are based only on internal factors, and a rolling forecast changes continuously, takes both internal and external factors into concern and looks at a shorter period.

Why static planning cycles are problematic

Many teams still run on annual planning cycles – sometimes with a mid-year revamp. But in today’s environment, that’s just not enough.

Markets move fast. A price change from a key supplier, a regulation update, or even a sudden increase in demand can throw the entire plan off. And when you’re stuck in a projection vs forecast mismatch, static plans force you to react manually – which often means you’re already too late.

Imagine you’re a regional distributor for a pharma company. You’ve set your yearly sales targets in Q4. By March, two key products are held up in customs, and a new competitor launches a cheaper generic. At this point, there’s no structured way to re-forecast revenue. So the team either needs to rework everything manually (meaning weeks of work) or hope to catch up next quarter.

Neither is a good option.

Static planning also leads to “plan gaming” – managers over- or under-committing based on fixed targets. And because the numbers don’t evolve with real activity, actual vs. plan variance becomes more about luck than insight.

What’s the fix? Let’s talk about rolling forecasts.

Rolling forecasts: how they work and why they win

Rolling forecasts don’t wait for the annual planning cycle to catch up. They shift the mode from set it and forget it to adjust and adapt. Instead of forecasting once a year, you update regularly – usually monthly or quarterly – and always look 12 to 18 months ahead.

That means the forecast window rolls forward every time you update.

Here’s how that helps:

- You always have a forward-looking view based on the latest data.

- You can act earlier when trends shift – not six months later.

- Forecasting becomes part of the business rhythm, not a one-time panic move.

Rolling forecasts also build better alignment across departments. Sales, marketing, and operations work from the same starting point. And finance doesn’t only control the numbers, set the limits or approve/reject plans – it becomes a business partner.

Read 7 Reasons Why Forecasting is Important For Your Business

What makes rolling forecasts hard (and why spreadsheets are the problem)

Most finance teams want to do rolling forecasts. But when they try, they hit the same wall: spreadsheets.

Manual inputs, endless numbers of versions, broken links, offline files – it’s not just slow, it’s risky. Updating even one version of a rolling forecast in Excel can take days. Coordinating across departments? Add another week. And that’s assuming no errors have happened along the way.

The challenge isn’t the logic – finance teams know what they want to model. The problem is that spreadsheets are built for static reporting, not agile forecasting. Spreadsheets don’t scale, they don’t integrate well, and they don’t support collaboration across teams.

Also, without automation or version control, every forecast cycle feels like reinventing the wheel. Which is why many teams just give up and stick with projections – even if they know it’s not ideal.

So how do you break that cycle?

How Farseer Enables True Rolling Forecasting

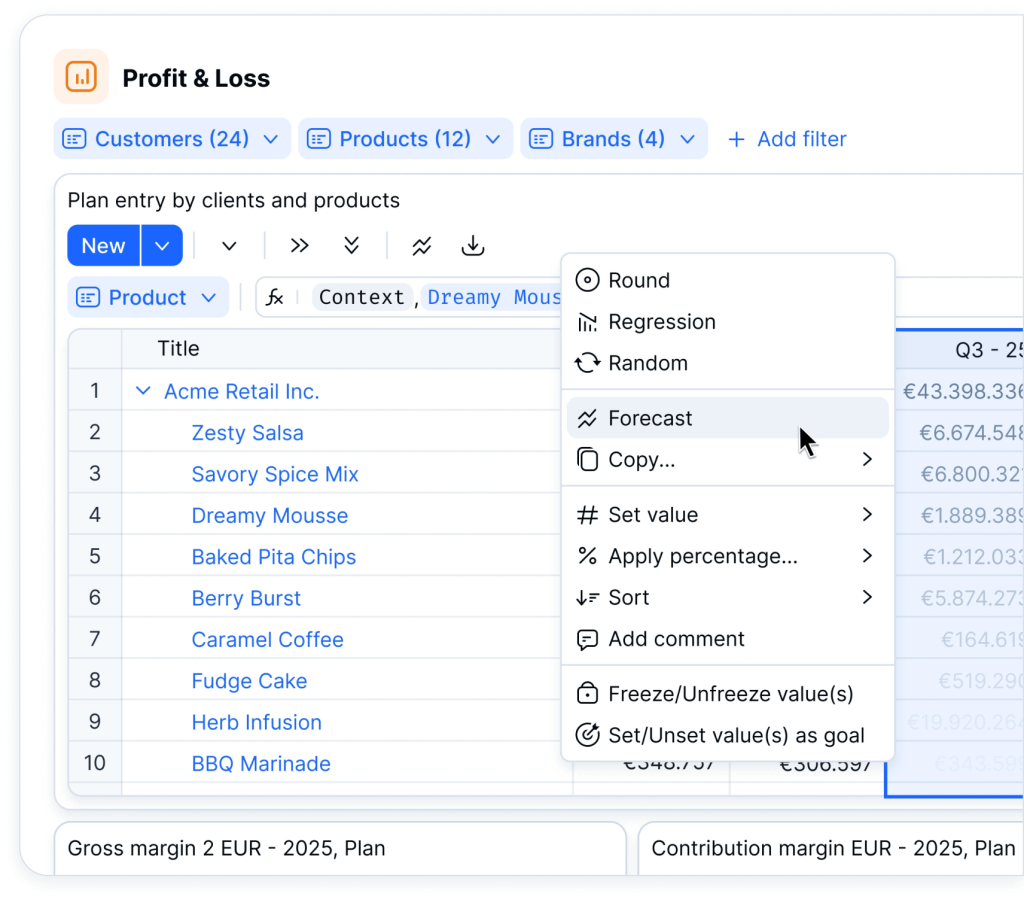

Rolling forecasts only work if the process is fast, reliable, and easy to maintain. That’s exactly where Farseer makes the difference.

Farseer is built specifically for finance teams that need flexibility without losing control. You can create and update rolling forecasts in hours and actually involve other departments without the chaos of email threads and broken Excel files.

Here’s what teams use Farseer for:

- Integrated planning: Actuals flow in automatically from your ERP or BI tool, so you’re always working with current data.

- One model for the whole business: Link sales drivers, operational KPIs, and financials in a single model. If sales volume changes, margin and cash flow update instantly.

- Versioning and collaboration: You can run multiple forecast scenarios side by side – like a base case and a conservative case – and share them with your team in real time.

- Speed: With built-in logic and automation, forecast updates that used to take days now take minutes.

This is how rolling forecasts should work – fast, collaborative, and always up to date.

Practical Next Steps for Companies Stuck With Projections

If you’re still relying on static projections, shifting to rolling forecasts doesn’t mean rebuilding your whole planning process overnight. But it does mean rethinking how and when you update your numbers.

Here’s how to get started — step by step:

- Pick one area to pilot. Start with a high-impact part of the business like revenue, COGS, or OPEX. You don’t need to roll forecast everything at once.

- Set a rolling forecast cadence. Monthly is ideal for most companies. Keep a consistent time frame – for example, always looking 12 months ahead.

- Define your key drivers. Think volume, price, cost per unit, headcount. Build your forecast around these drivers so changes flow through the model automatically.

- Use actuals as a trigger. Every time you close the month, update the forecast. Create a habit.

- Stop over-polishing. Rolling forecasts are meant to be fast and flexible – not perfect. The goal isn’t to predict every number exactly, but to have up-to-date inputs that point you in the right direction when making decisions.

- Get the right tool. If you’re still battling with spreadsheets, it won’t work long-term. Start with a tool like Farseer that gives you structure without locking you into rigid templates.

One tip from finance leaders who’ve made the shift:

Involve department heads early. They have the real insights, and when they’re part of the process, forecast accuracy improves fast.

Stop Guessing, Start Adjusting

When looking at projection vs forecast, it’s clear that projections give you a starting point – but in fast-moving markets, that’s not enough. Rolling forecasts let you adjust as you go – with real data, not guesses from six months ago.

Companies that stick to static planning fall behind. They react late, miss opportunities, and spend more time explaining variances than improving performance.

Rolling forecasts change that. You stay aligned, act faster, and make decisions based on what’s actually happening – not what you hoped would happen.

If your current process feels slow, manual, or disconnected, it’s time to rethink it. Start small, pick a tool that works for finance (and everyone else), and build a forecasting process that actually keeps up with your business.

Farseer is built to help you do exactly that.