Retained cash flow happens after you cover the basic expenses. You use it to invest in your business, pay off debt, or handle surprise expenses.

If you’re always feeling short on cash or relying too much on loans, you should pay more attention to retained cash flow. It’s about knowing where your money is going and ensuring you’re keeping enough to stay ahead.

Read: A Complete Guide to Financial Statement Analysis for Strategy Makers

In this blog, we’ll explain what retained cash flow means for your business, how to calculate it, and what you can do to improve it. So let’s go.

What is Retained Cash Flow?

Retained cash flow (RCF) is the cash your business keeps after covering all your main expenses, including operating costs, taxes, debt payments, and dividends. It’s the difference between what comes into your business and what goes out over a month, quarter, or year.

It’s different from other financial metrics because it focuses on actual cash, not just profits or accounting figures. For example, free cash flow (FCF) shows how much cash you have after large investments like equipment purchases but doesn’t include dividends. Retained earnings metric, on the other hand, tracks profits kept over time but it isn’t connected to the real cash your business has on hand.

In simple words, retained cash flow is like the money left in your wallet after you pay your monthly bills, loan payments, and living expenses.

Why is Retained Cash Flow Important?

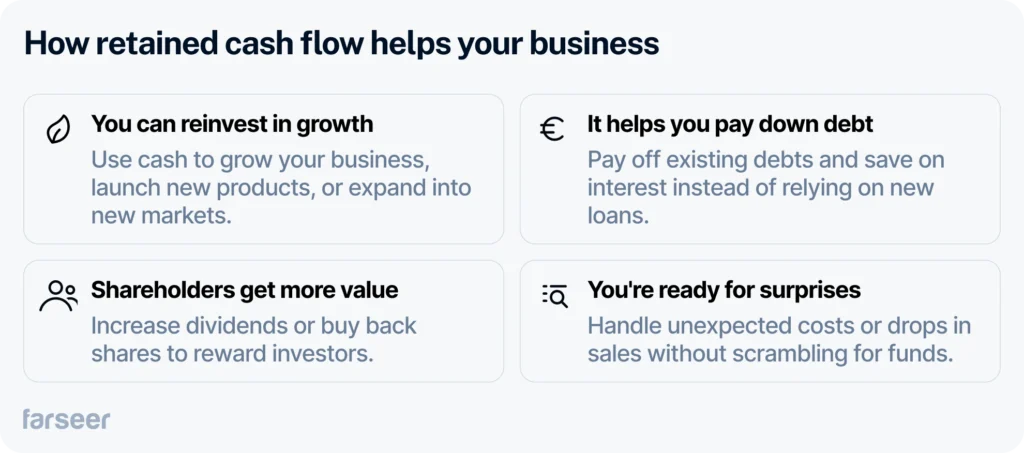

Retained cash flow is what gives your business the cash to grow and stay secure. When there’s enough left after covering the essentials, you can reinvest in new products or expand into new markets without taking on extra debt.

It also helps with debt management. Instead of relying on loans, you can use retained cash flow to pay off what you owe and save on interest. For shareholders, it allows you to increase dividends or buy back shares.

Having retained cash flow also means you’re better prepared for surprises. Whether it’s a sudden drop in sales or unexpected costs, keeping cash on hand helps you manage without scrambling for funds.

Example: let’s say an FMCG company retained €2 million in cash flow last year. Instead of borrowing, they can use the cash to enter a new region, which will potentially increase their revenue by 15%.

Retained cash flow matters because it gives you the cash to grow, stay flexible, and handle challenges without putting your business at risk.

Managing your retained cash flow starts with optimizing what comes in and goes out. Learn more about improving your working capital in our guide on net working capital.

How to Calculate Retained Cash Flow - Formulas

While the idea of RCF is simple, there are different ways to calculate it depending on the situation.

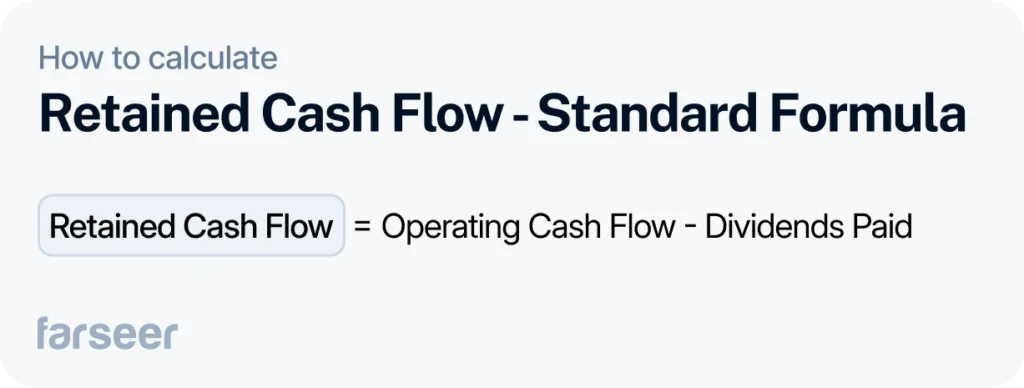

Standard Formula

The most common way to calculate retained cash flow. It focuses only on the cash generated by your operations and subtracts shareholders dividends. This formula is straightforward and works well for businesses that aren’t making significant investments in fixed assets like equipment or infrastructure.

Why use it?

It provides a clean and simple view of how much cash is left from day-to-day operations after rewarding shareholders. For SMEs or companies in stable industries, this is often enough to understand how much cash they retain.

Drawbacks

It doesn’t account for capital expenditures (CAPEX) like purchasing machinery or upgrading facilities. As a result, it may paint an overly optimistic picture of available cash for businesses making significant investments.

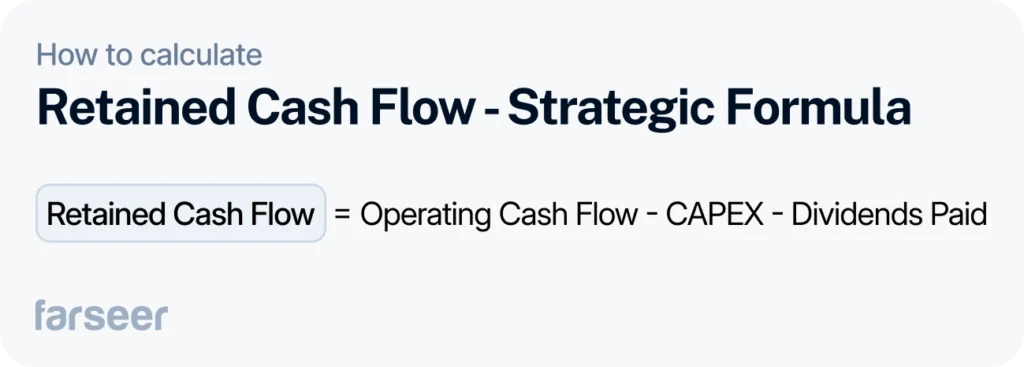

Strategic Formula

This formula looks at the cash your business has left after paying for operations, making investments in things like equipment or infrastructure, and rewarding shareholders with dividends. It’s a more detailed way to see how much cash is truly available after reinvesting in your business.

Why use it?

If your business is growing or relies on big investments in assets, this formula gives you a clearer picture of how much cash you actually have left. It’s useful for businesses that regularly spend on upgrades or expansions.

Drawbacks

This formula might show less cash than you expect, especially if your business doesn’t make many big investments. It’s also less relevant for service businesses that don’t spend much on assets.

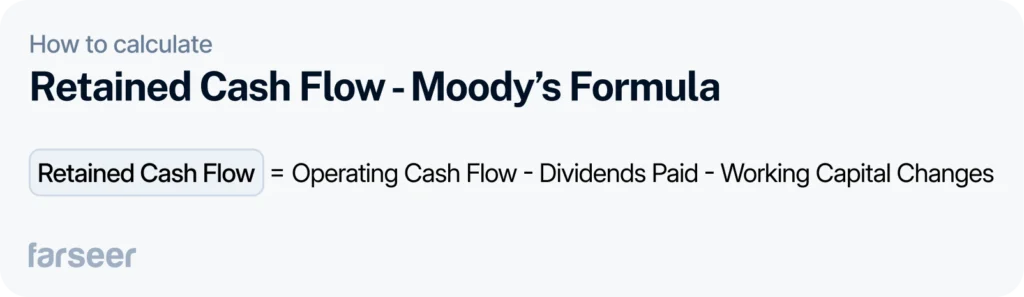

Moody’s Formula

This version of the formula adds working capital changes into the mix. It looks at how much cash is tied up in inventory, accounts receivable, accounts payable, etc. With these changes, it gives a better view of your cash flow and how short-term operations impact the cash you retain.

Why use it?

This formula is especially helpful for businesses that need to manage liquidity closely. It’s commonly used by credit rating agencies, like Moody’s, to assess how much cash is available to cover debt and maintain financial stability.

Drawbacks

Working capital changes make this formula more complex. It may also makes retained cash flow harder to predict: short-term fluctuations in receivables, payables, or inventory can heavily influence the numbers.

Understanding retained cash flow starts with knowing how cash moves through your business. For more on that, check out our guide on the direct cash flow method.

Example: Calculating Retained Cash Flow for FreshCo

FreshCo, a mid-sized FMCG company that sells packaged foods and drinks, had the following numbers last year:

- Operating Cash Flow: €3,500,000

- CAPEX: €1,000,000 (spent on new production lines and expanding their warehouse)

- Dividends Paid: €500,000

- Net Working Capital Changes: €300,000 (from higher inventory and receivables during peak season)

Using the standard formula:

RCF = Operating Cash Flow – Dividends Paid

RCF = €3,500,000 – €500,000 = €3,000,000

This shows €3 million left after paying dividends but doesn’t account for big investments or short-term cash needs.

Using the strategic formula:

RCF = Operating Cash Flow – CAPEX – Dividends Paid

RCF = €3,500,000 – €1,000,000 – €500,000 = €2,000,000

Here, FreshCo had €2 million left after reinvesting €1 million in new equipment and warehouse space.

Using Moody’s formula:

RCF = Operating Cash Flow – Dividends Paid – Working Capital Changes

RCF = €3,500,000 – €500,000 – €300,000 = €2,700,000

This shows €2.7 million left after accounting for €300,000 tied up in inventory and receivables.

FreshCo used its retained cash flow to expand production and warehouse capacity. This allowed them to meet demand, enter a new regional market, and increase annual sales by 20%.

Retained Cash Flow vs. Free Cash Flow

Retained cash flow (RCF) and free cash flow (FCF) are easy to mix up, but they are not the same. FCF tells you how much cash is left after capital expenditures, so it’s useful for short-term decisions like investments or paying dividends.

RCF includes dividends in the calculation. It tells you how much cash stays in the business for things like growth or paying off debt. For example, if a company has €1 million in FCF but pays €400,000 in dividends, its RCF is €600,000.

Comparing your actual cash flow to what you planned can help you manage retained cash flow better. Learn more in our guide on budget vs actual analysis.

How to Improve Retained Cash Flow

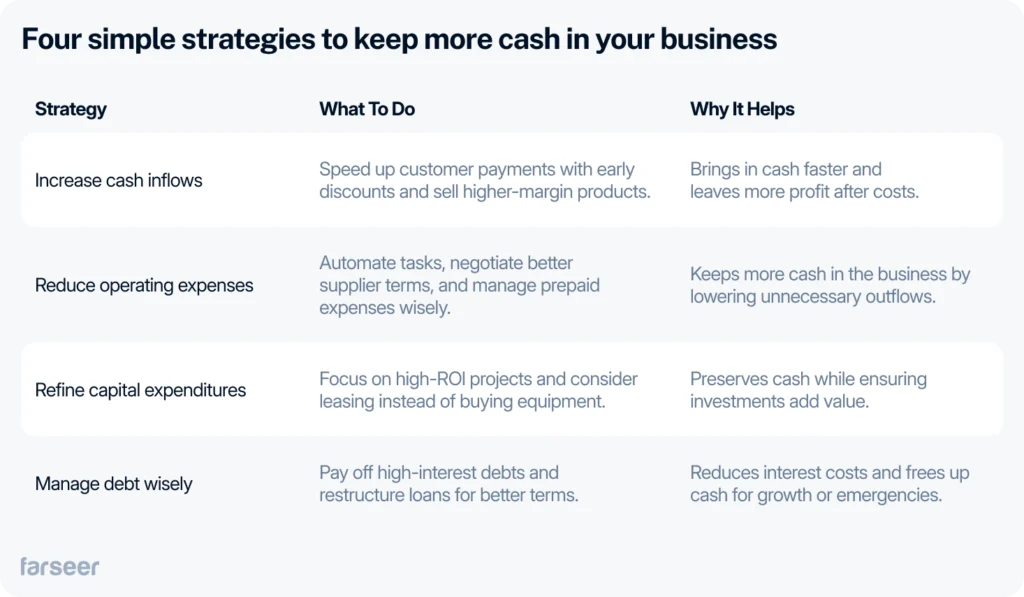

Retained cash flow improves when you actively manage what comes in and goes out. Here are some ways to make it happen.

Increase Cash Inflows

Getting cash into your business faster helps you keep more of it. Start by improving how quickly customers pay. Offering early payment discounts can bring in cash sooner, so it’s available when you need it.

Selling higher-margin products or expanding into new markets can also leave more money in the business after covering costs.

Learn more about improving cash flow with our guide on efficiency ratios.

Reduce Operating Expenses

Keeping costs down means keeping more cash in your business. Automate tasks like financial reporting to save time and money, and talk to suppliers about extending payment terms so your cash lasts longer.

Be smart about prepaid expenses too—overpaying upfront can tie up cash you might need for other priorities.

Get practical tips on cutting costs in our guide on improving your current ratio.

Refine Capital Expenditures

Big purchases like equipment or upgrades can eat into your cash fast. Stick to projects that give you the most value and think about leasing instead of buying to keep more cash in the business.

Spend smarter, not more.

Manage Debt Wisely

Using your retained cash flow to pay off high-interest debts can save you money and free up cash in the long run. You can also talk to lenders about restructuring loans to lower your monthly payments or interest rates.

Paying down debt means you’ll rely less on borrowing, leaving more cash for your business.

Conclusion

Retained cash flow helps your business stay stable and grow. By managing your cash wisely, you can invest in new opportunities, pay off debt, and handle surprises without stress.

With tools like Farseer, tracking and planning your cash flow is simple. You’ll have the clarity you need to make smarter decisions and keep more cash in your business.

Take control of your cash flow today and build a stronger future for your business.