A financial model that moves forward one month at a time. More agile. Significantly better than traditional budgeting. Improves operational performance. Grows profitability. All of these describe a rolling forecast. But how does it function? Why does it matter? And most importantly – does it work?

This guide will take you through the world of rolling forecasts. You’ll learn more about what they are, why they matter, and how exactly they are better than traditional methods in financial planning and analysis (FP&A). After reading, you’ll understand why rolling forecasts have become a vital tool for businesses of all sizes and how you can harness their power to drive your company’s success.

So, read on.

What Is A Rolling Forecast?

Rolling forecast is a financial planning method that continuously updates projections for a set period into the future. Traditional annual budgets remain static but rolling forecasts change constantly, incorporating the latest data to provide an up-to-date view of the company’s financial future. In other words, with a rolling forecast, planners project 12 to 18 months in the future, adding the latest actual data as time passes.

Key aspects of rolling forecasts

- They update constantly: Rolling forecasts are updated regularly, monthly or quarterly, so they reflect the latest inputs and market conditions.

- Their time horizon is consistent: Usually, it covers 12 to 18 months. After one period ends, another one is added, so the forecast ‘rolls’, so to speak.

- They are driver-focused: Rolling forecasts focus on key business drivers that shape financial performance, rather than detailing every line item.

- They look forward: Though based on historical data, rolling forecasts still focus on the future, and help anticipate and prepare for new challenges and opportunities.

- They are adaptable: Rolling forecasts quickly incorporate changes in the business environment, so they are significantly more flexible than traditional budgets.

Rolling forecast vs. Traditional budgeting

Let’s compare rolling forecasts to traditional budgeting more closely:

The image above shows how rolling forecasts offer a more flexible, forward-looking point of view to financial planning compared to traditional budgets. In today’s fast-paced and ever-changing business environment, this agility is more critical than ever.

Also, it’s important to note that there are some drawbacks of rolling forecasts to traditional budgeting. Setting the process up can be time-consuming and costly, especially if it’s not automated. As Larysa Melnychuk states: “Attempting to produce a rolling forecast for a multimillion or multibillion-dollar company in Excel is almost impossible”. So it’s best to implement it with robust FP&A software. Melynchuk also suggests that forecasting shouldn’t be connected to performance evaluations, because it can lead to overly emotional and optimistic forecasting bias.

Why Rolling Forecasts Matter More Than Ever

Rolling forecasts are becoming a must-have for agile companies wanting to thrive in the business context of the future. Here are some of the reasons they matter more than ever:

More accurate budgets and time savings

According to IBM’s research, a rolling forecast is 12% more accurate than a traditional budget. Companies that use it spend 50% less time on budget preparation, and their profitability grows by 10%.

Rolling forecasts are data-driven

With the explosion of big data and advanced analytics, businesses generate more information than ever before. Rolling forecasts provide a framework for continuously incorporating the data into financial plans, which leads to more informed and data-driven decision-making.

A clearer view of the future

Rolling forecasts provide visibility into financial and operational performance for months, sometimes even years ahead, which allows companies quick responses to changes. It also allows the leadership to stay informed and make better and faster decisions based on solid information.

Fit with fast-paced industry changes.

Rolling forecast constantly updates to reflect a company’s strategic direction. It perfectly aligns with agile principles, which support planning in iterations and quick shifts. They are crucial for adapting to rapid market changes.

Reduced risks

They also enable early identification of risks and opportunities allowing for quick strategic adjustments. This became obvious during the COVID-19 pandemic, showing the potential of rolling forecasts to quickly adjust plans in response to unexpected global crises or specific industry disruptions.

Faster decision making

When businesses move away from fixed budgets, rolling forecasts promote a culture of proactive management and ongoing improvement. They enable companies to be truly proactive, instead of only reacting to outside stimuli.

Building confidence

Rolling forecasts’ fresh insights increase investor, board member, and stakeholder confidence in financial management and strategy. A constantly updated view of the future results in better resource allocation, so funds and efforts are directed where they will have the most impact.

Giving the company a competitive advantage

In fast-moving sectors, the ability to quickly adapt financial plans can be a significant competitive edge. Rolling forecasts enable companies to seize opportunities and manage risks more swiftly than competitors relying on traditional budgeting methods.

A Step-By-Step Guide To Implementing Rolling Forecasts

Now that we understand why rolling forecasts are important, let’s see how to implement them in your organization. Here’s an easy step-by-step guide to help you:

Step 1: Evaluate the processes you have

Start by reviewing and documenting current financial planning processes. It’s always a good idea to secure top-level buy-in by showing how rolling forecasts can improve decision-making and align with long-term strategy goals.

Step 2: Set clear objectives

Clearly articulate what you want to achieve with rolling forecasts and specify the forecast horizon (12, 18, or 24 months), how often you’ll update them (monthly, quarterly), and the primary business drivers you will want to track (revenue growth, production efficiency, customer retention rates, etc).

Step 3: Select the right tools

As we mentioned earlier, rolling forecasts in Excel are not ideal. Luckily, there are many FP&A (Financial planning and analysis) tools out there that can help you. You will want to look for integration capabilities, user-friendliness, and scalability. Also, it’s smart to talk to your IT department at this point, to make sure that chosen tools can integrate with existing IT infrastructure.

Step 4: Create a framework

Next, you will want to build a flexible model that starts with your key business drivers and allows for incremental complexity. Make sure it integrates financial with operational data and that it can adapt to scenario-based planning.

Step 5: Train your team

Time spent on training is time well spent. Organize detailed sessions to educate everyone involved on the benefits and operations of rolling forecasts. Create training materials to fit specific department needs and focus on hands-on practice.

Step 6: Integrate different data sources

Automation is your friend. Automate data collection where possible to save time and reduce errors. Make sure that all data sources feeding into the forecast are reliable, that they update regularly, and provide a holistic view of business performance. Once again, good FP&A software can make a world of difference here.

Step 7: Launch a pilot program

Before rolling out to the entire company, start small. Select one department or business unit where rolling forecasts can make the most impact first. During the pilot, it’s crucial to compare how effective it is against the traditional forecasting methods, so you can iron out the kinks in the process.

Step 8: Monitor and refine

Chances are that without clear KPIs, it’s going to be hard to pinpoint how successful you are. Set KPIs to measure the success of rolling forecasts against your objectives. You should use these metrics regularly to assess performance and adjust the forecasting process when something goes wrong.

Step 9: Expand and scale

Based on the pilot results, you should gradually roll out the rolling forecasting process across the organization. The keyword here is gradual. Gather constant feedback from everyone involved and make changes and improvements to the process when necessary.

Remember, rolling forecasting is not a one-off event. It’s a continuous process of refining and improving. Patience and flexibility are key. Both you and your team should constantly keep the long-term benefits of the process in mind, to navigate the transition successfully.

Best Practices For Rolling Forecasts

Know the key business areas

Focus on the most important parts of your business instead of trying to cover everything. This will make updates faster and the process easier to manage. Walmart, for instance, zeroes in on holiday sales to better manage inventory and staffing during peak seasons, ensuring their resources are allocated where they matter most.

Use simple models and actuals

Link your financial predictions to what happens in the real world, like actual sales or production rates. That way, your forecasts will be more accurate. Coca-Cola ties its forecasts to seasonal beverage trends, adjusting production schedules based on real-time promotional responses, and keeping its forecasting process closely aligned with consumer demand.

Automate whatever you can

We can’t stress this enough. Use software that automatically handles data entry and calculations. There are plenty of them, and they will help you avoid mistakes and save time for more important work. And you’ll need it. Procter & Gamble, for example, automates data collection across its global markets, allowing it to adapt swiftly to shifting consumer buying patterns without manual input.

Work together

One thing that will help you get a better picture of the company is to gather input from all departments so forecasts are relevant. IKEA does this by involving product design, supply chain, and store management teams in forecasting to ensure that new product launches are smoothly coordinated and all operational areas are aligned.

Keep updating with new info

You should constantly check and update forecasts to make sure they make sense as the business changes. Zara, for instance, updates its fashion trend forecasts every two weeks to keep its clothing lines fresh and aligned with current consumer tastes, allowing it to react quickly to shifts in demand.

Plan for different outcomes

Think about the future, and everything that can happen. Include those scenarios in your forecasts, and you’ll be ready for the future and have contingencies. Nestlé prepares multiple demand forecasts that take into account different economic conditions, helping them maintain optimal stock levels and stay prepared for a variety of market scenarios.

Better fast than perfect

Try to forecast as quickly as you can, maintaining reasonable accuracy. If you try to make everything perfect, you’ll end up late, which defeats the purpose of rolling forecasts. Amazon prioritizes speed in updating its forecasts, allowing the company to quickly adjust its supply chain operations and capitalize on new trends, rather than getting stuck in pursuit of precision.

Learn from differences

Your main goal is to figure out why actual numbers are different from forecasts. Use the information to improve on your next forecast. Tesco, for example, regularly reviews seasonal sales forecasts against actual performance, refining their inventory and promotional strategies based on what they learn.

Explain the numbers

Always give context, and share the story behind the numbers. This will help everyone in the process understand how important the forecast is for the business. Unilever takes a similar approach, providing detailed explanations of forecast variances in its quarterly reports to ensure stakeholders understand the operational and strategic decisions behind the numbers.

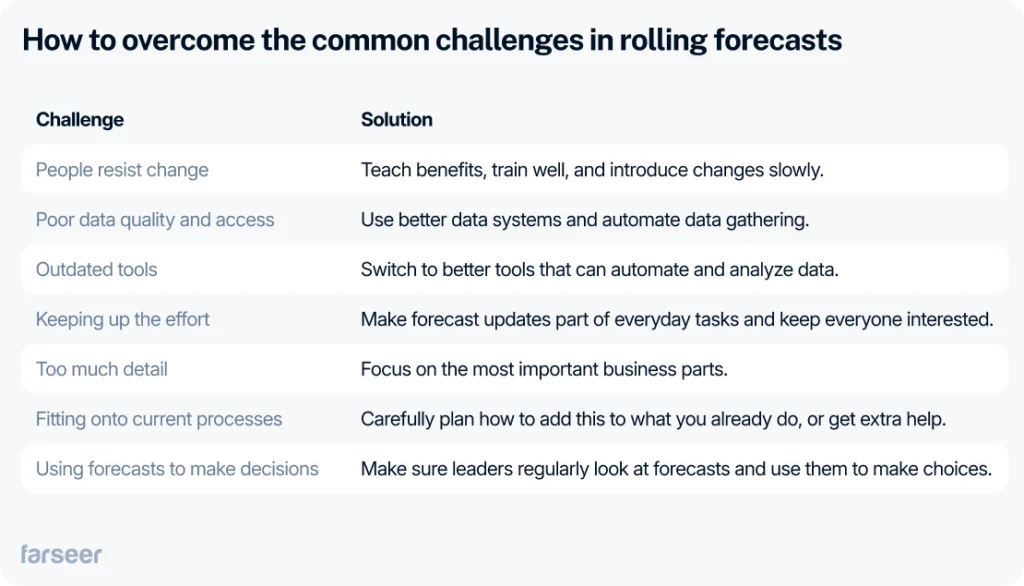

How to Overcome the Common Challenges in Rolling Forecasts

Rolling forecasts can be incredibly useful, and come with many benefits, but as always, there are some challenges and pitfalls involved. Here are some some common ones and what to do when they appear:

Challenge 1: People don’t like change

It’s not news. People get used to how they do things and prefer that over new ways. Companies eventually get entrenched into traditional budgeting processes, and employees will probably resist the shift to rolling forecasts.

Solution: Explain the benefits of rolling forecasts to the people involved, provide good onboarding and training processes, and implement changes gradually.

When Century Link transitioned to rolling forecasts, their employees were not happy. So, they started with a small rollout in specific departments and combined that with targeted training and strong executive sponsorship. This eased the transition, and employees eventually accepted the new system, because they realized that it simplifies their workload.

Challenge 2: Data quality and availability for rolling forecasts

To get rolling forecasts rolling, you’ll need quick access to accurate data from across the organization, and you’ll have to eliminate data silos.

Solution: Invest in reliable data management systems, automated data collection, and clear data governance policies. When people are responsible for this, mistakes and delays are inevitable.

Coca-Cola had fragmented data across multiple bottling locations, so its decision-making was lacking. They solved this by integrating data from 250 bottlers into a unified platform, eliminating data silos. This significantly improved their rolling forecasts and aligned global operations more effectively.

Challenge 3: Lack of appropriate tools for rolling forecasts

As we mentioned earlier, spreadsheets will fall short. Rolling forecasts are too dynamic for a rudimentary tool such as Excel.

Solution: Besides automation, and better analytical capabilities, a tool like Farseer will also help with getting buy-in from other stakeholders in the company.

Unilever had similar challenges when their Excel-based cash flow forecasting became inefficient across their global operations. They integrated a forecasting tool, to improve their processes, reduce errors, and get real-time visibility across different regions. This resulted in more accurate forecasts, reduced manual work, and overall better business decisions.

Challenge 4: Maintaining initial rolling forecasting momentum

Rolling forecast implementation is the first step, but our organization might struggle with maintaining regular updates to keep everything working spot-on.

Solution: Forecast updates should be built into your regular financial processes. Assign clear responsibilities and talk about the great value of the rolling forecast to keep everyone engaged.

Maersk Group successfully integrated rolling forecasts by embedding them into their quarterly financial planning process. They decentralized responsibility, and gave business units a chance to own their numbers. The regular review made rolling forecasts a core part of decision-making rather than a one-off task, helping build and maintain momentum over time.

Challenge 5: Balancing detail and efficiency in rolling forecasts

With all this taken into account, you might be tempted to go too deep into detail and forecast too granularly. That’s dangerous because you might lose valuable time, and ignore the bigger picture.

Solution: Focus only on key business drivers, they have to be your priority. Make sure you know what’s being forecast and why every once in a while, and you’ll achieve balance.

Many large companies like Heineken improve their operations by focusing on key metrics like market share and profitability. That allows them to improve overall efficiency and simplify processes.

Challenge 6: Integrating rolling forecasts with existing processes

There are multiple financial processes and reporting requirements in your company. Rolling forecasts must fit into the bigger picture of them all.

Solution: Plan your activities carefully. You may need to deprioritize other tasks, or, if that’s not possible (as often happens) you might want to look into additional hiring, or search help from outside consultants.

When Royal Dutch Shell implemented rolling forecasts, they had to align them with their complex financial and operational processes. Shell worked with consultants to make sure the integration didn’t disrupt their reporting and compliance. They gradually embedded rolling forecasts into standard operations and improved forecast accuracy while staying efficient.

Challenge 7: Translating rolling forecasts into action

Forecasts don’t matter if you don’t do anything about them. They have to drive direct action and better business decisions.

Solution: Establish clear processes for decision-makers to regularly review the forecasts and adapt the strategy. Without their buy-in, rolling forecasts don’t make a lot of sense.

Danone integrated rolling forecasts into their decision-making processes by regularly reviewing forecasts and adapting their strategies based on forecast data. That way their management could act swiftly, and adjust production, supply chain, and marketing decisions based on the latest insights, making sure that forecasts directly influenced business actions.

The Future Of Rolling Forecasts

There are several trends shaping the future of rolling forecasts, and most of them are technology-related. Let’s learn more about them:

AI and machine learning in rolling forecasting

Just like everything else, AI and machine learning will revolutionize rolling forecasts. The technology behind these can analyze vast amounts of data in an instant, identify patterns humans aren’t able to, and generate predictions significantly faster than anything we’ve seen so far. KPMG already uses AI-driven intelligent forecasting to help companies improve accuracy, integrating predictive analytics and external data to create highly adaptive forecasting models.

Increased integration of non-financial data into rolling forecasts

Future rolling forecasts will likely incorporate a wider range of non-financial data: social media sentiment, weather patterns, or even geopolitical events. This holistic approach will provide a better and more detailed view of broad factors affecting business performance. Research shows that companies that integrate non-financial data, such as customer insights and operational metrics, achieve up to 95% forecasting accuracy, significantly outperforming those relying solely on financial data.

Real-time forecasting

These are the natural next steps coming with the advent of new tech enabling significantly better processing power. Instead of monthly or quarterly updates, forecasts will very soon be adjusted immediately as the new data becomes available. Companies like NTT DATA are already leveraging real-time data through demand sensing technology, allowing businesses to continuously update forecasts based on factors like weather patterns and market conditions, ensuring more accurate predictions and faster responses

Enhanced visualization and storytelling in rolling forecasts

Data without the story doesn’t mean a lot. Compelling storytelling is at the center of any good report. It’s only natural to expect significant advancements in data visualization and narrative generation tools, making forecast insights more accessible even for non-financial stakeholders. New tools like Infogram now offer real-time data visualizations and customizable storytelling options, integrating AI to create dynamic narratives that help businesses communicate insights effectively across various industries.

Predictive analytics

So far, rolling forecasts have been primarily based on historical data and current trends. Future models will increasingly incorporate predictive analytics, though. Businesses will be able to not only forecast based on what has happened but to anticipate the future and its potential impact. PepsiCo uses predictive analytics through its pepviz tool to forecast consumer demand, enabling better inventory management and more effective marketing strategies by analyzing real-time sales and customer behavior data.

Blockchain for financial planning and forecasting

Blockchain technology has been on the rise for some time now. It could revolutionize the data integrity aspect of rolling forecasts and FP&A by providing an immutable, transparent record of all financial transactions. In the context of financial planning and analysis (FP&A), blockchain can ensure that the data used to create rolling forecasts is accurate, auditable, and protected from tampering. Visa’s blockchain implementation in B2B payments shows how the tech improves processes by eliminating manual reconciliation, a common challenge in financial planning. Real-time data accuracy and transparency ensure that forecasts continuously reflect the latest information, reducing errors and the time needed for adjustments

Increased automation in rolling forecasts

Even now, we’re seeing more and more automation in the office of finance, but this will only increase. This could include automated data collection, anomaly detection, and even automated generation of narrative insights based on forecast data. Deloitte is leveraging automation to enable continuous, real-time updates to financial forecasts by integrating operational and third-party data streams. This helps reduce manual work, allowing CFOs and finance teams to focus on higher-level analysis and decision-making, improving both the speed and accuracy of rolling forecasts.

As these trends develop, rolling forecasts will become even more powerful tools for businesses and at one point, they will probably become a norm for decision-makers around the world.

Conclusion

Industries will keep getting faster and more challenging, and quick adaptations to changing conditions will be more crucial than ever. Rolling forecasts already are, and will become even more important and irreplaceable tools for businesses trying to conquer the markets.

By moving away from traditional, annual budgets, rolling forecasts enable businesses to:

- Quickly respond to market changes

- Make more informed, data-driven decisions

- Align financial planning with strategy

- Improve accuracy in financial projections

- Enhance stakeholder confidence

It might be challenging to implement rolling forecasts, but the benefits outweigh the hurdles by far. By adopting the right mindset, tools, and approach, any company can successfully use rolling forecasts to drive its FP&A to new heights.

In the future, rolling forecasts will become more sophisticated and even more important for business success. They will improve with AI and real-time updates, and help businesses stay ahead of the curve.